Is GAP Insurance Worth Buying?

Whenever you buy a car from a dealership these days, at some point in the sales process you’ll be offered the chance to buy GAP insurance. If you want to know what GAP insurance is and if it’s worth buying with a new or used car, then read on.

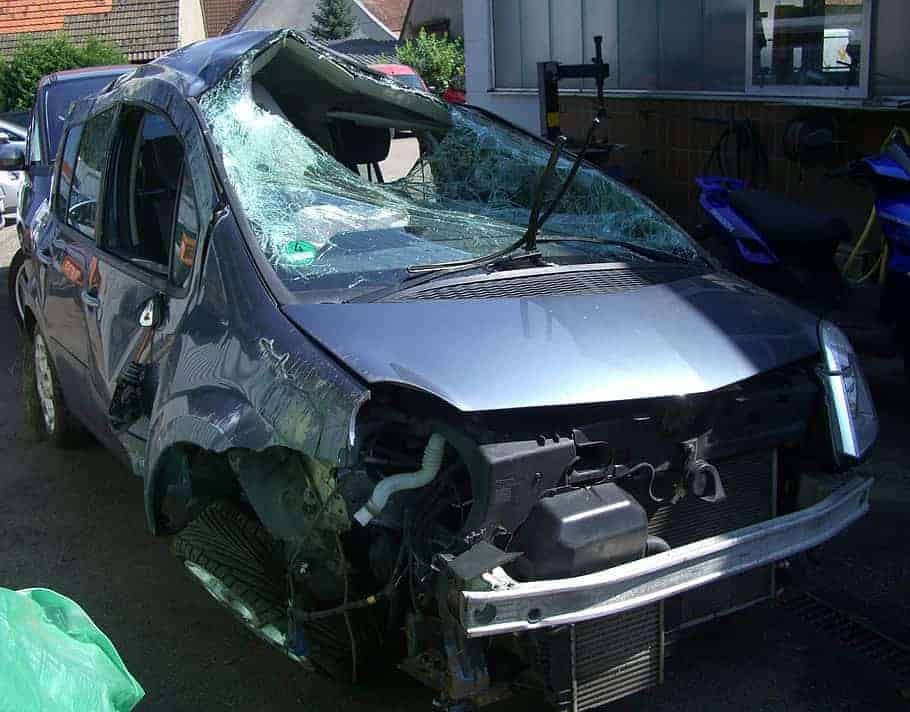

GAP insurance is a policy that pays out when a car is written off or stolen and not recovered and pays the difference between the insurance payout and the original purchase price or the outstanding finance settlement, whichever is greater. Like all insurance policies, you really will think it was worth buying if you need to claim on the policy.

In this article I’m going to answer the following questions:

- What is GAP insurance?

- How does GAP insurance work?

- How does finance GAP work?

- What vehicles are eligible for GAP insurance?

- How long does a GAP insurance policy last for?

- Is GAP insurance transferrable?

- How much does GAP insurance pay out?

- How much does GAP insurance cost?

- Do you need GAP insurance?

- Is GAP insurance just for new cars?

- Is GAP available for all used cars then?

- Is GAP insurance worth buying?

What is GAP insurance?

GAP insurance – Guaranteed Asset Protection insurance – is a separate insurance policy that runs alongside your main car insurance policy. It’s normally sold by dealers as part of the car buying process, but it can also be sold separately from the dealership by finance companies or insurance brokers.

The policy will pay out when a car is written off or is stolen and never recovered. It’s a sort of top-up policy that’s designed to avoid you being out of pocket due to the insurance payout for your loss being less than you paid for the car or less than the outstanding finance settlement owed on the vehicle.

The amount of money it pays to the policyholder the difference between what the insurance company pays out in the event of a total loss claim and the original purchase price or outstanding finance settlement, whichever amount is greater.

How does GAP insurance work?

When a car is written off or stolen and unrecovered, the owner will claim on their vehicle insurance in the normal way. However, if they have an active GAP policy as well, the company that runs the GAP policy will also need to be notified so they can get involved too.

This is a no-lose situation for you as the policyholder because the GAP insurance provider will want to ensure the main insurer pays out the correct amount to minimize the amount they have to pay to make up the shortfall. Either way, you are not going to lose out financially.

How does finance GAP work?

GAP comes in two forms, although some GAP policies will cover both circumstances. If you don’t have finance on your vehicle but you do have GAP and you suffer a total loss, the policy will pay out the difference between what the insurance company is prepared to pay you and the original invoice price you paid for the car.

Finance GAP differs from standard GAP because it isn’t really concerned with what you paid for the car originally. Instead, a finance GAP policy pays the difference between what the insurance company is prepared to pay out and the finance settlement figure at the time of the loss if it is more than the amount the insurance company values the car at.

If the insurance settlement is bigger than the finance settlement figure, then the policy will pay the difference between the insurance payout and the original invoice price. If you have a specific finance GAP policy and not one that covers both situations if the insurance settlement is more than the outstanding finance amount the policy won’t pay anything.

This is why where insurance GAP policies are sold they can be cheaper to buy than a full-blown GAP policy.

Most GAP policies will cover both eventualities, but in some countries, they offer separate total loss and finance GAP policies as well as combined policies.

What vehicles are eligible for GAP insurance?

Most vehicles are eligible for GAP insurance, but different companies will have different criteria concerning age and mileage. Most of the time a company will accept a vehicle that is less than ten years old and has less than 100k miles on the odometer at the time of sale. Some companies will look at older or higher mileage vehicles, but some could be even stricter.

A normal retail GAP policy may not cover vehicles bought for commercial use, such as those bought to be used by taxi companies or driving schools.

How long does a GAP policy last for?

A GAP policy will last for a set amount of time (typically three years) or until the vehicle is sold or a claim on the policy is made. If the vehicle is bought on a finance agreement and the GAP policy covers the finance, the policy will run until the term expires, the vehicle is sold, or until a claim is made.

Is GAP insurance transferrable?

GAP insurance cannot be transferred to another vehicle, to another person, or to another finance agreement. If you sell the car the policy cannot be transferred to the new owner in the way some warranties can be, and if you sell the car and buy another you’ll have to take out a new policy if you want to be covered by GAP insurance.

How much does GAP insurance pay out?

How much GAP insurance pays out will depend on the policy and the amount of loss at the time of the claim. Most total loss policies will have a maximum amount stated that they will payout in the event of a total loss claim, and if your loss is greater you will only get the maximum amount stated in the terms and conditions.

Not surprisingly and like any insurance policy, the larger the amount of cover the more the policy will cost to take out. Most of the time, you will only be able to take out a policy that’s considered right for the value of the vehicle you are buying. If you are buying a vehicle for $10,000 for example, you shouldn’t be able to take out a policy that covers a potential shortfall of up to $35k.

It’s the same with the finance element of GAP too. The level of protection offered by the policy will be appropriate to the size of the loan you take out.

How much does GAP insurance cost?

When purchasing gap insurance as a standalone policy online, the typical cost is a one-off payment of between $200 and $300. Taking out gap coverage as part of a general auto insurance policy will probably be the best value option, but if you include it as part of a finance agreement you’ll end up paying considerably more as you’ll be paying interest on the GAP policy as well as the vehicle purchase.

Do you need Gap insurance?

There is no legal requirement for you to have GAP insurance, even if it’s the law where you are that you have to have regular vehicle insurance to be able to drive on public roads. Whether you need Gap insurance is really up to you.

In some cases, when you take out a lease or a finance agreement the finance company may require you to have GAP insurance, but that doesn’t mean it will necessarily be included as part of the lease or finance agreement.

If you are not in a position to buy your vehicle outright for cash and therefore have to use finance, it stands to reason that you’re not going to be in a good financial position if you have to make a total loss claim after a year or two if you don’t have GAP. In that case you not only won’t have your car anymore, you could also find yourself still owing money to the finance company because you owe them more than the insurance company says your car was worth and pays out at the time of the loss.

Is GAP insurance just for new cars?

No, GAP insurance isn’t just for new cars, but there is a case to be made for it being more important for new cars than for used cars. New cars depreciate more than used cars do, so the buyer of a new car stands to lose a greater proportion of their money if they suffer a total loss as a car loses the biggest proportion of its value in those first few years.

Is GAP insurance available for all used cars then?

GAP is usually only available for purchases of used vehicles up to a certain age and a certain mileage. As mentioned earlier, a common threshold for eligibility will be up to 100,000 miles on the odometer or up to ten years old at the time of sale. Outside of the stated parameters, a car will not be eligible for GAP insurance coverage.

To qualify for eligibility, a used car must be under both thresholds. In the case of the parameters above, a used car that only has 23,000 miles on the odometer still wouldn’t be eligible if it was more than eight years old. Likewise, a three-year-old car wouldn’t be eligible for GAP if it had done more than 100,000 miles at the time of the sale.

Is GAP insurance worth buying?

Just like any insurance policy, most people will probably only think it’s worth buying if you end up needing it. If you pay for a GAP policy and never make a claim on it you get nothing out of it other than peace of mind. Whether that peace of mind is worth what you are asked to pay for the policy will be up to you and your own financial circumstances.

What I can tell you from considerable experience in the auto trade is that those people I’ve sold GAP to that end up claiming on it have been incredibly pleased and thankful that I sold it to them.

A common reason for people declining to buy GAP insurance from me was that they’ve never written a car off or had a vehicle stolen, so they don’t see the point or the need for it. If you can figure out the logic in that argument you’re smarter than I am.